UK COMMERCIAL PROPERTY RECORDS -4.0% CAPITAL VALUE CHANGE IN Q3

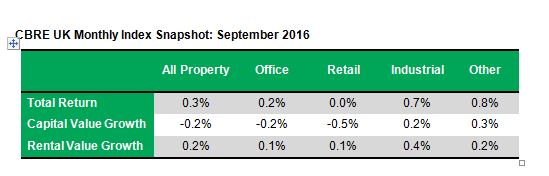

Rental values across the UK’s commercial property market increased slightly in September after holding firm for two consecutive months after the EU referendum, according to the latest CBRE Monthly Index. Capital values decreased again but at a slower rate than over the previous months.

Capital values fell by -0.2% in September, a deceleration in the rate of falls seen in both July (-3.3%) and August (-0.5%). This reduction in the decline of capital values suggests a dissipating Brexit effect. In Q3 2016, capital values fell by -4.0% across all sectors in the UK, significantly lower than the 0.5% growth recorded in Q2 2016. The impact on rental value growth was less severe, with rental values growing by 0.2% over Q3 and 0.6% in Q2.

Office capital values across the UK fell slightly by -0.2% in September. The Office sector has seen the most significant falls in values since the EU Referendum, with capital values falling -5.1% in Q3 versus growth of 1.0% in Q2. City of London offices performed worse than other office segments and saw capital values decrease by -0.8% in September, a slightly larger decrease than August’s -0.6%. Capital values fell among City offices in Q3 by -7.4%, the most significant fall of all segments as the sector is seen as the most exposed to the impacts of Brexit.

Rental values throughout the Office sector remained relatively stable in September, with an overall increase of 0.1% being mostly driven by the 0.2% increase in Rest of UK offices rental value.

In contrast to UK offices, industrials recorded a strong performance on all key measures. Capital values rose by 0.5% in the Industrial sector, while rental values increased by 0.4%. Industrials outperformed all other sectors in terms of total returns, recording 0.7% in September. Despite falls in capital values over the quarter (-2.2%), the Brexit impact on the Industrial sector has been less severe due to continued high demand and growth in retail sales, coupled with a historically under-supplied sector.

With three full months having now passed since the EU Referendum, there is a clearer picture of the impacts of the ‘Leave’ vote. Since the EU referendum values have fallen significantly though at a decelerating rate. The uncertainty around the UK’s relationship with Europe has increased the perceived risk of holding UK assets and pushed yields upwards.