CAPITAL VALUES RISE 2.5% ACROSS UK COMMERCIAL PROPERTY IN H1 2017

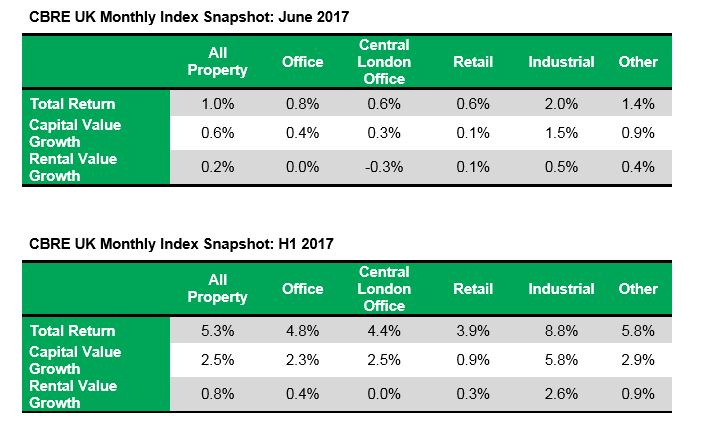

UK commercial property capital values increased 0.6% overall in June 2017 according to the latest CBRE Monthly Index. A quarter-end surge from the Industrial sector helped boost the national average. Rental values increased by 0.2% across All UK Property over the month.

Over H1 2017, capital value growth reached 2.5%, up some way from H1 2016’s 0.6% but still shy of the 4.1% recorded in H1 2015. Rental value growth was 0.8% for H1, lower than the 1.1% in the same period in 2016. Propped up by steady income returns, total returns hit 5.3% for the first half of 2017.

The Industrial sector returned to previous form, with capital values rising 1.5% in June 2017, up from 0.5% in May. Capital growth was driven by Industrials in the South East, which reported a 1.8% increase for the month. Industrials in the Rest of UK posted a respectable increase of 0.9%. Industrial rental values rose 0.5% over the month. In H1 2017, capital values in the Industrial sector rose 5.8%, while rental values increased 2.6%. Total returns were 8.8% for UK industrial as a whole, and 9.9% for South East industrial.

Retail capital values increased 0.1% overall in June, with high street shop capital value growth of 0.2% for the month. Rental values also increased slightly, with the sector reporting growth of 0.1%. In H1 2017 capital values in the Retail sector increased 0.9% overall, with high street shops in the South East reporting an increase of 1.3% over H1. Rental values increased by 0.3% over the same period.

The Office sector recorded capital value growth of 0.4% over the month of June, boosted by performance outside of Central London. Outer London/M25 Offices reported capital growth of 0.5%, while Rest of UK Offices recorded growth of 0.6%. While rental values at the all UK office level were flat in June, this disguised a divergence in performance between Central London, where rental values fell -0.3%, and markets outside the capital, where rental values rose. Capital values in the Office sector as a whole increased by 2.3% in H1 2017. Rental values increased 0.4% across the sector in H1.

June’s results mark the end of H1 2017 and 12 months since the EU referendum. Despite City office rental values falling for a third consecutive month, overall results paint the picture of steady property performance. Industrials in particular continue to perform well and provide a boost to overall performance