CBRE forecasts 300m sq ft of additional European logistics space will be needed by 2025 to meet rising e-commerce demand

Globally, e-commerce growth to require additional 1.5B sq ft of industrial space

E-commerce sales across Europe are expected to increase by $298bn from 2020 to 2025, requiring an additional 298 million sq. ft. of industrial warehouse and distribution space to meet growing demand in this sector, according to a new report from CBRE.

Total e-commerce sales across Europe increased by 150% over the last five years, with online sales rising from 7% of the total sales market in 2015 to 13% of the market in 2020.

CBRE estimates that every additional $1 billion of e-commerce sales globally requires 1 million sq. ft. of new distribution space. Globally, e-commerce sales are expected to increase by $1.5 trillion in the next five years, requiring an additional 1.5 billion sq ft of e-commerce related logistics space, with 298 million of them needed in European countries.

“E-commerce has grown steadily over the years, but as many consumers changed their buying habits during the pandemic, we saw activity accelerate,” said Jack Cox, Managing Director, EMEA Industrial and Logistics. “This will continue to place significant importance on distribution and supply chain networks, as well as support record performance of logisitcs properties. As long as this consumer base continues to grow, we believe the Logistics sector has more room to grow as well.”

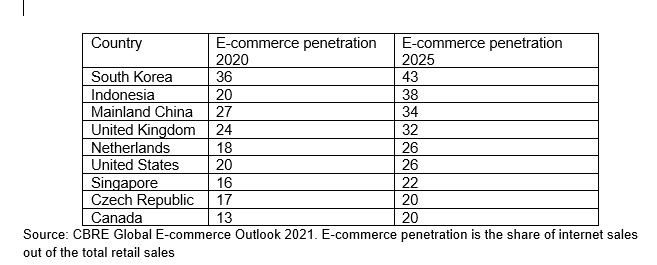

The United Kingdom currently has the third highest e-commerce penetration ratio globally at 24%, after South Korea (36%) and Mainland China (27%), and is expected to remain one of the largest e-commerce markets; by 2025, e-commerce penetration in the UK is forecast to be 32%. Other markets in Europe that are expected to see high e-commerce penetration are The Netherlands and the Czech Republic, with expected e-commerce penetration rates of 26% and 20% respectively. South Korea will see the world’s highest e-commerce penetration by 2025, at 43%.

To forecast growth, CBRE looked at such drivers as the percentage of the popularion living in urban areas, debit and credit card use, digital skills, and infrastructure, among several others.

Tasos Vezyridis, Head of I&L & Retail Research, CBRE concluded: “The European market is relatively polarised in terms of e-commerce penetration. There are a number of markets, including the UK, Germany, Sweden and The Netherlands which have many of the drivers already in place to facilitate high levels of e-commerce and this was accelerated during the pandemic. However, we believe many of the less established markets such as Portugal, Italy and Spain will see higher growth over the next five years and will start to catch up with the already dominant nations, resulting in growing demand for Logistics space in these markets and across Europe.”