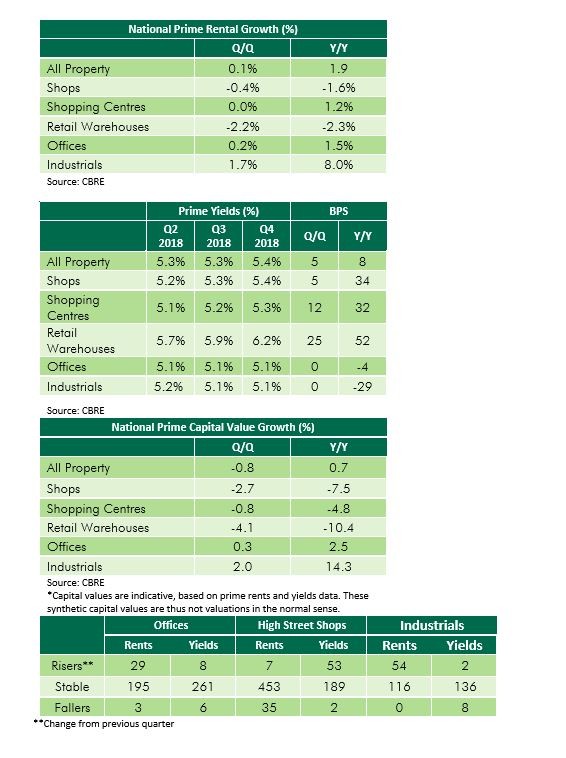

Prime UK commercial property rents up 1.9% in 2018

-Prime UK commercial property rents up 0.1% in Q4 2018

-The Industrial sector continues to outperform with prime rents increasing 1.7% in Q4 2018

- High Street Shop prime rents fell -0.4% over the last quarter.

- Prime yields at the All Property level increased slightly, ticking up 5bps in Q4

UK prime commercial property rental values increased 0.1% in Q4 2018, down from the 0.5% recorded in Q3, according to CBRE’s latest Prime Rent and Yield Monitor. Results in Q4 bring the overall growth in prime rental values to 1.9% in 2018 as a whole. Even including the immediate aftermath of the EU referendum, this is the lowest quarterly growth in prime rents since Q3 2012. Prime yields at the All Property level increased slightly over the quarter, ticking up 5bps. Both prime rents and yields results at the All Property level were driven by turbulence in the Retail sector.

Continued outperformance by the Industrial sector resulted in prime rents increased 1.7% in Q4 and brought annual growth to 8.0% for 2018. For the third consecutive quarter, prime Industrials in the North West outpaced other markets with growth of 3.1% in Q4. The London, South East, and Eastern markets also performed strongly, reporting growth of 2.2%, 2.1%, and 2.3% respectively.

Office prime rents increased 0.2% in Q4. In 2018, prime Office rents have increased 1.5% overall. Central London Office prime rents were flat over the quarter. While City prime rents increased 0.6%, prime rents in the West End and Mid Town markets decreased -0.2% and -0.6% respectively. Prime Offices in the Rest of UK (Excl. South East & Eastern) increased 0.2% in Q4. Office prime rents in the South East increased 1.0% over the quarter, while Eastern Office prime rents increased 0.9%.

High Street Shop prime rents fell -0.4% in Q4, marking four consecutive quarters of falling prime rents and bringing the decrease in prime rents in 2018 to -1.6% overall. Shops in the North East reported the greatest fall at -5.0% over the last quarter. No region reported an increase in High Street Shop prime rents in Q4 2018. Prime rents in Central London Shops fell -0.1% in Q4. Prime Shopping Centre rents were stable in Q4, while Retail Warehouse prime rents fell -2.2%.

Prime yields rose slightly in Q4, increasing 5bps over the quarter.

Industrial sector prime yields were stable in Q4. While prime yields decreased in the South West (‑5bps) and Scotland (-10bps), the East and West Midlands reported small increases in prime yields over the quarter, both moving out 4bps. Over 2018, prime yields for the Industrial sector have fallen -29bps.

Prime Office yields were also stable in Q4. Central London Office yields increased just 1bps over the quarter. The biggest movement of the quarter was reported in the West Midlands were yields increased 14bps. The largest decrease of -7bps was reported by Offices in Yorkshire & Humberside. Prime Office yields were also relatively stable over 2018, decreasing just -4bps.

High Street Shop prime yields rose 5bps over the quarter to reach 5.3%. While Central London prime yields were stable, Rest of UK (excl. South East & Eastern) prime yields increased 14bps, driven by movements in Scotland (21bps) and the North West (43bps). Shopping Centre prime yields increased 12bps in Q4. Retail Warehouse prime yields reported prime yields increasing 25bps over the quarter.

At the All Property level, prime rental growth was the lowest reported since Q3 2012, owing to falls in the Retail sectors. This is despite relative strength in the Office and Industrial sectors. Our Monthly Index results have shown the weak performance of more average Retail, particularly in the second half of 2018. Now our Prime Rent & Yield data shows that prime Retail is also coming under pressure, especially in pricing terms.