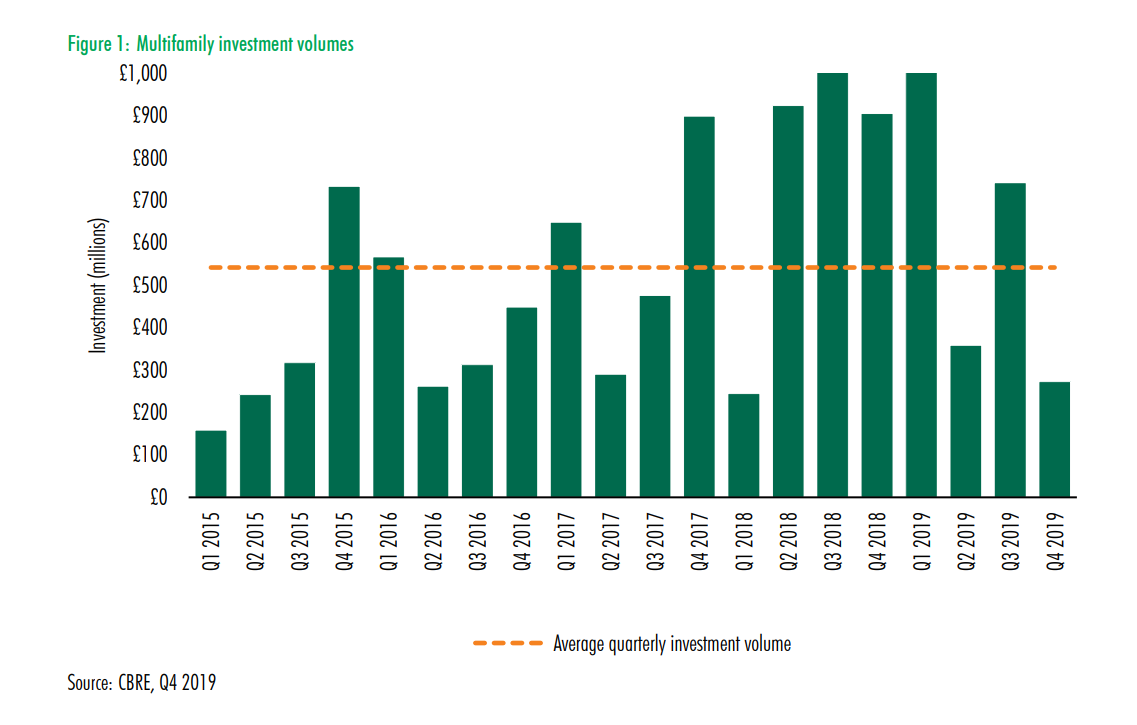

UK Multifamily: £274m transacted in Q4 brings total investment in 2019 to £2.4bn

£273.8m was invested into the UK’s multifamily housing sector (build to rent) in Q4, bringing the total investment in 2019 to £2.4bn, according to the latest research from global real estate advisor CBRE.

CBRE UK Multifamily Investment MarketView for Q4 2019 reports that while full year total investment is down 22% from 2018, the outlook for 2020 is favourable. There is £1.5bn worth of deals currently under offer, illustrating the continued high demand for the multifamily sector.

The majority of transactions in Q4 were forward funding deals, with the remainder in portfolio sales. Investment was approximately evenly split between London and the regional centres.

Transactions for the second half of 2019 have been subdued compared to the last two quarters of 2018, most likely as a result of market uncertainty around the General Election. This does not tell the full picture though and with the number of deals currently under offer standing at around £1.5bn, this suggests a different, and much more positive story going into the beginning of 2020. Indeed, there are some very significant deals throughout the UK, but particularly in the regions, with due diligence well progressed, which suggests that 2020 could be a record year for investment.

“Of particular note in Q4 was Grainger’s continued investment into the sector with three further transactions – a third forward funding deal in the Hallsville Quarter development in Canning Town, and two deals in Cardiff and Sheffield which indicates that appetite remains strong despite the disappointing volumes of transactions in the investment market.

“Moving into 2020 and beyond, the build to rent (BtR) market looks likely to continue its rapid expansion, especially with more and more developers considering it as a viable exit which should further boost investment, encourage new entrants into the market and should help alleviate the pressures of the demand/supply imbalance. In addition, 2020 could see the first few valuations of ‘true’, operational BtR investments as they begin to trade in the market.

According to CBRE’s annual UK Real Estate Market Outlook, the UK multifamily sector continues to attract substantial investment. CBRE forecasts that total residential investment will increase by approximately 30% in 2020. Demand is being driven by an increasingly diverse investor base from both domestic and overseas institutions. In addition, a subdued sales market is set to persist in 2020, meaning multifamily will be the preferred disposal route for many developers. Affordable housing providers are becoming a highly competitive force in the multifamily market, and will continue to invest in the sector throughout 2020.

Read the report: CBRE UK Multifamily Investment MarketView, Q4 2019