UK PROPERTY TOTAL RETURNS REACH 10.2% TO DATE

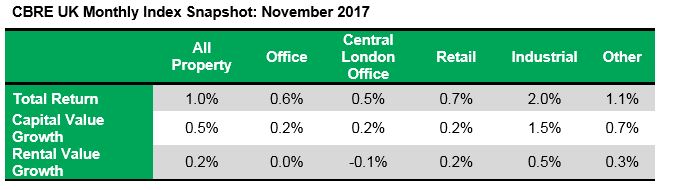

UK commercial property total returns reached 10.2% for 2017, at the end of November 2017, ahead of the IPF’s consensus forecast of 8.5% for 2017 as a whole. This is according to the latest CBRE Monthly Index. Total returns for November were 1.0% for All UK Property. Capital values increased 0.5% at the All Property level in November, boosted by the Industrial sector’s out performance. Rental values increased 0.2% over the month.

The Retail sector recorded capital value growth of 0.2% in November. Retail warehouses slightly outperformed the other subsectors for the second consecutive month with growth of 0.3%. Shopping Centre capital values were stable in November. Rental values in the Retail sector increased 0.2% over the month. High Street Shops in the South East reported flat rental values while Shops in the Rest of UK reported rental value growth of 0.1%.

Industrial capital value growth again outperformed the other main sectors in November, at 1.5%. South East Industrials slightly outperformed the Rest of UK with an increase of 1.6% compared with 1.4% for the latter. Rental value growth in the Industrial sector was 0.5%, with the South East again slightly outperforming the Rest of UK (0.6% and 0.2% respectively).

Capital values in the UK’s Office sector increased 0.2% in November. Capital values in the Outer London/M25 and Rest of UK markets increased 0.4% and 0.3% respectively while the City submarket recorded a decrease in capital values of -0.1%. Both the City and West End & Mid Town submarkets reported a decrease in rental values in November (-0.1% and -0.2% respectively). Rental values were flat in Rest of UK Offices. Outer London/M25 Office rental values increased 0.4% over the month.

UK property has performed steadily and above expectations in 2017 so far, with total returns now in double digits. Industrials continue to lead the way.