New CBRE Student Accommodation Index shows strong increase in capital values

·London properties see major boost in total returns

·Capital values for large assets rose 7.2% pushing total returns to 12.9%

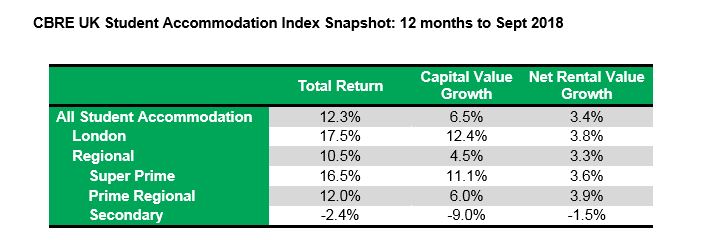

UK Student Accommodation continues to gather momentum amongst investors, with capital values increasing 6.5% year on year (to September 2018) according to CBRE’s newly launched Student Accommodation Index. This is up from the 4.5% recorded in the previous year (to September 2017).

On a gross and net basis, rents rose 3.0% and 3.4% respectively. At the national level annual total returns were 12.3% for the year to September 2018.

The index is disaggregated into ‘Central London’ and ‘Regional’ geographies, the latter being further split into Super Prime, Prime, and Secondary.

Student Accommodation in Central London outperformed Regional by some margin. Driven by capital value growth of 12.4%, Central London Student Accommodation annual total returns reached 17.5% for the year to September 2018, compared with 14.2% for the previous 12 months. Regional Student Accommodation annual total returns to September 2018 were 10.5%, with capital growth of 4.5%.

Of the properties located outside of Central London, Student Accommodation situated in Super Prime towns reported capital growth well above those in Prime Regional and Secondary locations (11.1% compared with 6.0% and -9.0% respectively). While gross rental value growth was positive in all three categories, net rental value growth showed much more of a divergence. Net rental value growth in Super Prime and Prime Regional towns in the 12 months to September 2018 was 3.6% and 3.9% respectively. In Secondary locations, net rental value decreased -1.5% over the year.

Large Student Accommodation properties (500+ beds) slightly outperformed small (less than 250 beds) and medium (250-500 beds) properties for the year to September 2018. Capital values for large assets rose 7.2% pushing total returns to 12.9%. Capital growth in small (5.8%) and medium (6.2%) Student Accommodation properties resulted in total returns of 11.6% and 12.2% respectively.

This first published Student Accommodation Index demonstrates the continued strong performance of the sector which has outperformed the CBRE Monthly Index over the last 8 years. UK Student Accommodation is now firmly established as a mainstream investment sector. Investors will find the increasingly sophisticated raft of influences on performance highlighted by this index, including location, asset scale, university rankings, applications, and distance to university very informative.