UK Multifamily: £743m boost in Q3 brings total investment in 2019 to £2.1bn

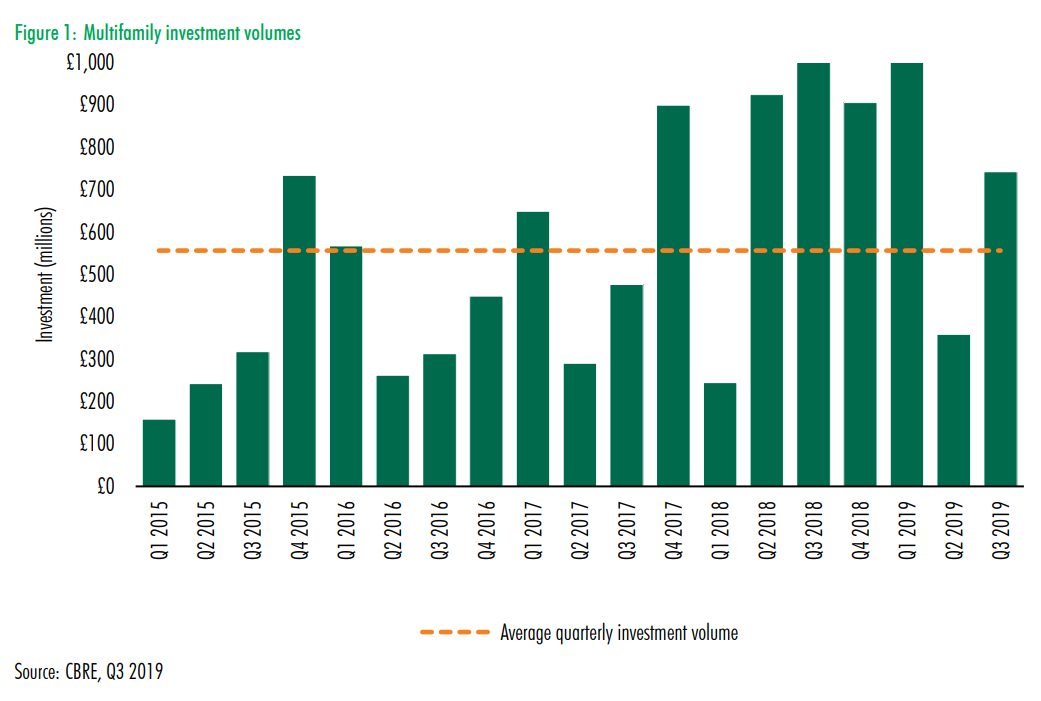

Over £2bn has been invested into the UK’s multifamily housing, or build to rent (BTR), sector in the first three quarters of 2019, according to the latest research from global real estate advisor CBRE.

Multifamily is a burgeoning asset class in the UK, and investment volumes have grown considerably each year. Total investment into UK Multifamily over the last five years has now reached £10.6bn, according to CBRE’s tracking.

Investment into the UK’s multifamily sector picked up in the third quarter of 2019. There was £743m of investment into UK multifamily housing in Q3 2019, more than double the £359.4m recorded in the previous quarter. Forward funding transactions accounted for the bulk of activity by transaction type in Q3 (£630m). These were split between London and regional cities.

There were notable firsts in Q3. Mitsubishi Estate London made their debut multifamily acquisition in the UK, agreeing the £150m forward funding of a Galliard Group development in Nine Elms. Outside of London, Invesco made its first investment in Birmingham, exchanging contacts with High Street Group to provide £98m to fund 484 apartments in the city centre.

The multifamily market remains stable, reflecting no marked yield shifts between Q2 and Q3 2019. Prime net yields continue to range from 3.25% to 4.25%.

There is strong momentum going into the final quarter, with around £650m of transactions under offer, including just over half (£335m) located in prime regional centres.

Investment in the multifamily sector is contributing to the delivery of new housing. According to British Property Federation figures, there were 1,967 new construction starts in Q3. This is up from the 727 recorded in the last quarter. 2,617 homes completed in Q3, which was an increase of 32% year-on-year.

Investors are attracted to the secure, long-term income profile and the diversification play of multifamily housing, all of which is all underpinned by the strong supply and demand fundamentals of the UK housing market. The transactions in Q3 illustrate investors are continuing to focus on London and regional cities, which is closely aligned to where the renter demand is.

In addition, many investors are encouraged by the potential upside that can be gained from the right approach to product design and management. For renters, there is now a much greater appreciation for the lifestyle offer of multifamily – essentially paying for convenience, as well as a sense of community. And this is exactly what many of the multifamily operators aim to provide.

Peoples’ lifestyle preferences are changing at a faster rate than materials can depreciate, which means our challenge is hyper-focused around how we create a built product that can evolve and retain its relevance and attractiveness over the long-term.

Read the report: CBRE UK Multifamily Investment MarketView Q3 2019